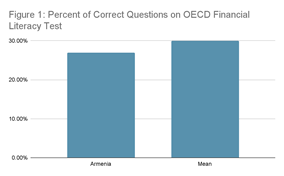

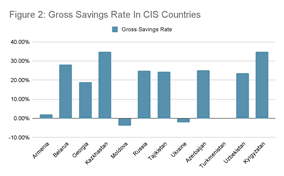

Financial literacy is broadly defined as an individual’s financial knowledge and ability to use financial tools to execute his or her financial goals. The people of Armenia demonstrate a level of financial literacy (Figure 1) and gross savings rate (Figure 2) that is lower than the average financial literacy of Commonwealth Independent State Countries (CIS). Understanding and having access to financial tools is vital so that one can most effectively and efficiently manage his or her money and achieve financial and life goals. Savings are especially important as an individual becomes older and considers retirement. Ample savings are required in order to maintain a lifestyle. The goal of this article is to assess the possible ways to increase the savings rates in Armenia via making banking tools more accessible and plentiful.

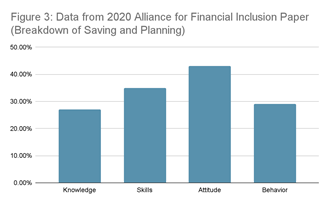

In the Alliance for Financial Inclusion paper, in 2020, The Financial Competency Matrix for Adults, out of all six sub-sectors of financial literacy on the capability barometer, saving and planning had the lowest topic scores at 34%. The capability was further broken down. Knowledge was 27%; skills was 35%; attitude was 43%; and behavior was 29% (Figure 3). This shows that overall literacy on savings must be increased for Armenians. The most popular way of saving in Armenia is by saving cash. Saving cash does not allow for growth of balance via earning interest. Banks in Armenia offer attractive deposit rates, which individuals should take advantage of.

In certain CIS countries there are a number of impediments to savings. One such restraint may be that there is a minimum deposit amount required or the bank is too far from the individual’s village. In addition, there is a lack of trust between individuals and the bank. In 2008, the International Labor Organization’s survey showed that about 30% of people do not trust the bank and about 75% of people do not understand account conditions. The Central Bank of Armenia’s National Strategy from 2015-2017 has been very effective at developing financial system regulations, supervision and financial infrastructure. In spite of the fact that these initiatives have helped to build trust in the Armenian Banking System, the saving rate still is low.

Banking structure in Armenia is adequate and not a major cause of inadequate savings. Armenia has more bank branches per 100,000 people than the average country analyzed by the International Monetary Fund. This demonstrates that the issue with savings is not that there is a lack of banks compared to other countries. Physical infrastructure in rural areas is one of the main issues limiting savings in rural areas, accompanied by lower incomes, financial literacy and still developing trust in the financial system. Lessons can be learned from how other countries have appealed to rural savers. Strategies utilized in other similar countries have included mobile banking, banking on wheels, postal banking, and informal savings clubs.

About 65% of people in Armenia are internet users. This compares favorably with average internet penetration worldwide which is about 60%. Armenians have access to financial tools online, suggesting further education and advocating for mobile banking would be effective. If Armenians utilized mobile banking more, it would provide them with nearly ubiquitous access to financial services. Financial literacy courses should more prominently educate individuals on mobile banking infrastructure as a key tenet of financial literacy.

Banking on wheels is popular in poor rural areas where individuals do not have the means to get to a bank. It essentially brings the bank to the people, which in turn promotes financial well-being. Opportunity International and Credit Suisse have been working together to implement Banking on Wheels in Malawi. The benefits are targeted at small business owners as it also allows them to take out loans to grow their businesses. This, in turn, creates a better livelihood for their clients, allowing them to be able to put food on the table for their children and buy the necessities. This alternative to the traditional bank branch has also been used in India. Through research, it was shown that in India, the people that most frequently visit the bank on wheels are housewives or about 31-45 years old. The customers the researchers interviewed discussed how they loved that concept and wished it was more widely marketed. Banking on wheels also is more real than having someone bring your money to a bank via informal savings clubs. This is also another alternative that could be popular in Armenia as some may not have the time or resources to travel to the nearest bank. The banking on wheels could be combined with informal savings clubs as there is still a minimum amount that must be deposited. Yet, there are some cons of banking on wheels, which include the fact that the bank must hire more people and the cost of an additional employee may not be worth it.

Postal banking is a way of banking at the local post office, which has been implemented in countries including Japan, Germany, South Korea, and China. It is a way to reach people if there is not a bank close by. It provides financial services to individuals in all parts of the country. In order for postal banking to occur, there must be a connection between the postal system and the financial system. The post office almost functions as a bank where people can receive their money, pensions, or pay utility bills. HayPost, a respected postal operator in Armenia since 2005, has offered money transfer services in all villages in Armenia. HayPost with the guidance and support of the Central Bank of Armenia Could initiate Postal Banking in Armenia.

While it is possible to make structural changes to encourage savings, individuals may only have limited resources available to save after the costs of living are covered. A great way to solve this issue is through informal savings clubs, when a group of people get money together to deposit in an account every month or week. Informal savings clubs are only used by 1% of people living in Armenia, which is similar to the rest of the region. The clubs create a sense of responsibility because if not all members of the group contribute money, the deposit might be below requisite deposit minimums. This responsibility creates accountability as it forces members of the group to check in on each other’s finances. In order for informal savings clubs to be successful there must be great trust between the individuals of the group. In addition there must be trust between the people and the bank. Eventually, It would be interesting to gauge individuals’ knowledge on informal savings clubs; this could be done via a survey.

Saving is essential to allow for an individual to prepare for financial surprises and retirement. Properly investing money allows for early retirement and less work. To ensure that individuals are fully on top of saving, there could be a legal requirement making banking reminders every month mandatory. There is proven research that shows that reminders can result in a substantial amount of growth in an individual’s bank account. It would be beneficial to the population if savings clubs became more frequent. They not only increase savings but they also create a sense of community around saving. If one member of the group is not able to contribute to the pool of deposits. There might not be enough money for the others to have their money added to the account. This creates a great sense of accountability. In addition, it would be beneficial if there was a policy that required banks to remind individuals every month to save. The policy is a small but significant one. With the awareness that Banks do not let individuals save less than $100, it would not be feasible to require everyone to save money.

Mobile banking, banking on wheels, postal banking, and informal savings clubs could help increase savings and financial well being of people in Armenia. The strategies are not only effective and efficient, but they make banking more accessible to people in rural areas. In addition, if the financial literacy programs more thoroughly discussed online banking and made sure all individuals were very familiar with its use, savings would increase. It would be beneficial if banking reminders were used more frequently to remind members to save and use the financial tools available to themselves. In conclusion, while Armenia has a continuously developing banking infrastructure and growing trust, steps discussed should be implemented to improve savings.